Last Updated on 11th December 2024 by Raj Padhiyar

The cryptocurrency market is poised for growth in the upcoming years, with a projected revenue of $11.71 billion expected in 2024 as per the report. To elevate your exchange or digital assets, market makers play a crucial role.

These professionals assist in managing market liquidity by engaging in the buying and selling of assets, particularly important for platforms and markets that necessitate a specific liquidity threshold. Notably, liquidity contributes to fair pricing, reducing the likelihood of arbitrage needs.

In the context of volatile crypto markets, liquidity serves as a stabilizing factor. It ensures a level of stability even during market fluctuations.

So, what exactly is a market maker in the realm of cryptocurrencies? Essentially, a crypto market maker employs diverse strategies to establish and sustain liquidity for digital assets. Liquidity, in this context, denotes the ease with which a digital currency can be exchanged or swapped with other assets, tokens, or fiat currencies.

Typically, a crypto market maker is an individual or entity well-versed in order books, algorithmic tools, and market-making strategies. Beyond providing liquidity, market makers have additional objectives, including risk management and narrowing price spreads to create efficient and cost-effective trades.

The process of crypto market making is not a one-size-fits-all solution. Instead, it involves the creation of a two-way market through buying and selling assets. This approach ensures that an asset remains liquid for both buyers and sellers, enabling them to trade at fair market prices on their preferred platforms. This strategy helps mitigate the risk of price manipulation, particularly given the largely unregulated nature of many cryptocurrency markets.

Understanding Crypto Market Making in 2025:

What is Market Making?

Market making involves providing liquidity to financial markets by simultaneously offering buy and sell orders for a particular asset. Market makers profit from the spread between the bid and ask prices while ensuring that traders can execute orders promptly.

How Does Market Making Work in Crypto Markets?

In the cryptocurrency space, market making functions similarly to traditional markets but with higher volatility and fragmentation across numerous exchanges. Crypto market makers use sophisticated algorithms to manage orders and inventory across multiple trading platforms, aiming to:

- Provide liquidity: Ensure there’s enough volume for traders to buy or sell without significant price impact.

- Stabilize prices: Reduce drastic price swings by balancing supply and demand.

- Enhance market efficiency: Improve the speed and reliability of trade executions.

The Role of Market Makers in Crypto Markets:

1 – Liquidity Provision

Liquidity is crucial for a healthy trading environment. Market makers fill the gap between buyers and sellers, making it easier to enter or exit positions without causing significant price movements.

2 – Reducing Volatility

By continuously placing buy and sell orders, market makers help smooth out price fluctuations, contributing to a more stable market.

3 – Improving Market Efficiency

Efficient markets benefit all participants. Market makers facilitate quicker transaction times and tighter spreads, enhancing the overall trading experience.

Criteria for Evaluating Crypto Market Makers

When assessing crypto market makers, consider the following factors:

1 – Reputation

- Track Record: Years of operation and success stories.

- Regulatory Compliance: Adherence to financial regulations and licensing requirements.

2 – Technology and Algorithms

- Trading Infrastructure: Advanced platforms capable of handling high-frequency trading.

- Security Measures: Robust protocols to protect assets and data.

3 – Fees and Costs

- Transparent Pricing: Clear fee structures without hidden charges.

- Competitive Rates: Reasonable spreads and commissions.

Market Coverage

- Exchange Access: Connectivity to major crypto exchanges.

- Asset Support: Ability to trade a wide range of cryptocurrencies.

Top 6 Crypto Market Makers in 2025

1. Fibot

Fibot is a premier crypto market maker renowned for its innovative algorithmic trading strategies and significant contributions to market liquidity.

Key Features:

- Advanced Technology: Utilizes cutting-edge algorithms for high-frequency trading and real-time market analysis.

- Global Reach: Operates across major cryptocurrency exchanges worldwide like XT.com, Bitmart, Kucoin, CoinDCX.

- Comprehensive Asset Support: Offers liquidity services for a wide array of digital assets.

- Offering Other Services: It also offers Influencer Marketing Services for Blockchain Projects, If you don’t know much about it, we have published detailed blog on How to Choose right influencer for your project.

Services Offered:

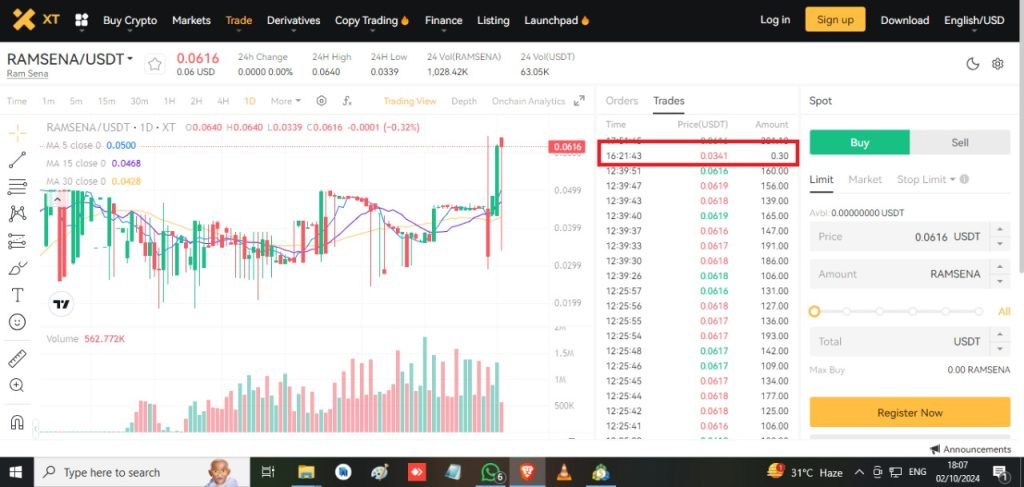

- Market Making: Provides tailored liquidity solutions for All Major exchanges and blockchain projects. PFA image for sample Market Making for one of the client of Fibot.

- Over-the-Counter (OTC) Trading: Facilitates large-volume trades with minimal market impact with required spread, volume in budget where there monthly package starts in just $250 with 3 days of Free trial.

- Advisory Services: Offers strategic insights on market trends and trading strategies regularly to blockchain projects.

2. Wintermute

Overview: Established in 2017, Wintermute is a leading global algorithmic market maker in digital assets.

Key Features:

- Operates on over 5+ exchanges worldwide.

- Provides liquidity for over 50+ cryptocurrency pairs.

- Offers over-the-counter (OTC) trading services.

Services Offered:

- Market Making: For exchanges and token projects.

- OTC Trading: Large-volume trades with minimal slippage.

- Advisory Services: Guidance on market strategies.

3. Jump Trading

Overview: Jump Trading brings decades of experience from traditional markets to the crypto space, offering high-frequency trading solutions since last many years.

Key Features:

- Advanced algorithmic trading technologies.

- Significant presence on major crypto exchanges.

- Strong focus on research and development.

Services Offered:

- Liquidity Provision: For institutional clients.

- Strategic Partnerships: Collaborations with blockchain projects.

- Customized Solutions: Tailored trading strategies.

4. Cumberland (DRW)

Overview: Cumberland is the crypto arm of DRW, a global principal trading firm with a strong reputation in financial markets.

Key Features:

- 24/7 global trading operations.

- Extensive network across various crypto assets.

- Emphasis on compliance and regulatory standards.

Services Offered:

- OTC Trading: Deep liquidity for large transactions.

- Market Making: Services for exchanges and token issuers.

- Advisory: Market insights and analysis.

5. GSR

Overview: GSR is a crypto trading firm specializing in market making and bespoke trading solutions.

Key Features:

- Expertise in both spot and derivatives markets.

- Proprietary technology for algorithmic trading.

- Partnerships with major crypto projects.

Services Offered:

- Market Making: Liquidity services across multiple exchanges.

- Risk Management: Hedging strategies and consulting.

- Structured Products: Customized financial instruments.

6. B2C2

Overview: B2C2 is a leading OTC liquidity provider and market maker in the crypto industry.

Key Features:

- Real-time pricing and execution.

- API integration for automated trading.

- Offices in London, Tokyo, and Jersey City.

Services Offered:

- Electronic OTC Trading: Instant quotes and settlements.

- Liquidity Provision: For institutional clients.

- White-Label Solutions: Customizable trading interfaces.

Comparison of Top Crypto Market Makers

| Criteria | Fibot | Wintermute | Jump Trading | Cumberland | GSR | B2C2 |

| Year Founded | 2022 | 2017 | 1999 | 2014 | 2013 | 2015 |

| Global Presence | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| OTC Services | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Exchange Coverage | Multiple | 50+ | Multiple | Multiple | Multiple | Multiple |

| Asset Support | Wide Range | 500+ Pairs | Various | Various | Various | Various |

| Regulatory Compliance | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

How to Choose the Right Crypto Market Maker

Thus Consider the following when selecting a market maker:

- Regulatory Standing: Ensure they comply with legal standards in your jurisdiction.

- Technology: Look for advanced, secure trading platforms.

- Experience: Prefer firms with a proven track record.

- Service Offerings: Match their services with your specific needs.

- Fee Structure: Understand all costs involved to avoid surprises.

The Future of Crypto Market Making

As the crypto market evolves, market makers will continue to innovate. Expect advancements in:

- Algorithmic Trading: More sophisticated models for better efficiency.

- DeFi Integration: Market making in decentralized finance platforms.

- Regulatory Developments: Greater compliance and oversight.

Conclusion

Crypto market makers play a crucial role in the digital asset ecosystem by providing liquidity, reducing volatility, and enhancing market efficiency. If you interested to boost your crypto project – Explore our Free Digital Marketing Course .

With Fibot leading the way alongside other top firms, traders and token projects have robust options to navigate the complex crypto markets effectively.

TalkOptions – Option Ka Search Engine

Start searching & analyzing options with various tools and options strategies. We strive our best to provide the best available tools for options analysis. Simple & Easy-to-use platform for Traders and Learners Customised Strategy Builder with Fast Strategies The Strategy Builder allows you to create your strategies with multiple Future & Options positions. It also gives you some pre-built fast strategies to explore—Free Gateway to Options Analysis.

For more information regarding Option trading visit https://web.talkoptions.in/

Real Estate Nice post. I learn something totally new and challenging on websites

Your blog is a treasure trove of knowledge! I’m constantly amazed by the depth of your insights and the clarity of your writing. Keep up the phenomenal work!

الاستمرار في توجيه الآخرين.|Ahoj, věřím, že je to vynikající blog. Narazil jsem na něj;

Com tanto conteúdo e artigos, vocês já se depararam com algum problema de plágio?

také jsem si vás poznamenal, abych se podíval na nové věci na vašem blogu.|Hej! Vadilo by vám, kdybych sdílel váš blog s mým facebookem.

Díky moc!|Hej, jeg synes, dette er en fremragende blog. Jeg snublede over det;

værdsætter dit indhold. Lad mig venligst vide det.

The novel viewpoints and unique angles are refreshing and completely subvert previous cognitions!

very helpful information

thanks for such valuable information

very informative blogs. realy helpful

balenciaga哪裡買最便宜?憑藉獨特的設計語言與舒適的背負體驗,在精品市場占有一席之地。其標誌性元素包括:柔軟高質感的皮革、金屬鉚釘裝飾與隨性垂墜的包型,展現出既個性又優雅的風格。不論是日常通勤還是休閒出遊,都能為穿搭增添時尚亮點。

Great insights shared on Digital Gurukul! The content is well-structured, easy to understand, and very helpful for learners looking to grow their digital skills. I especially liked the practical approach and real-world examples. Keep up the excellent work and informative posts!

The Abacus Trainer website offers the Best abacus online classes designed to boost speed, accuracy, and concentration in young learners.

abacus franchise in india

Great insights shared on the Digital Gurukul blog! The content is clear, informative, and very helpful for learners looking to upgrade their digital skills. I especially liked how the concepts are explained in a simple and practical way. Keep up the excellent work and valuable knowledge sharing.

The A3 Schools website is an online learning platform designed to provide students with engaging and interactive education.

online classes for students

This is a very informative article on digital marketing. I really liked the way you explained SEO strategies in a simple manner. Looking forward to more such valuable content. Thanks for sharing!